| 제목 | [산업동향] 2023년 3월 경제동향 |

|---|

| 분류 | 성장동력산업 | 판매자 | 노민우 | 조회수 | 42 | |

|---|---|---|---|---|---|---|

| 용량 | 2.72MB | 필요한 K-데이터 | 9도토리 |

| 파일 이름 | 용량 | 잔여일 | 잔여횟수 | 상태 | 다운로드 |

|---|---|---|---|---|---|

| 2.72MB | - | - | - | 다운로드 |

| 데이터날짜 : | 2023-03-08 |

|---|---|

| 출처 : | 국책연구원 |

| 페이지 수 : | 63 |

[ 차례 ]

주요 경제지표 Major Economic Indicators

요약 및 평가 Summary and Assessment

경제동향 주요지표 Major Indicators of the Korean Economy

1. 국내총생산(2015년 불변가격) ························································································· 33

Gross Domestic Product (at 2015 Constant Prices)

2. 경기 ······································································································································ 35

Economic Activity

3. 소비 ······································································································································ 37

Consumption

4. 설비투자 ······························································································································ 39

Equipment Investment

5. 건설투자 ····························································································································· 41

Construction Investment

6-1. 수출, 수입 및 교역조건 ··································································································· 43

Exports, Imports and Terms of Trade

6-2. 경상수지 및 금융계정 ······································································································ 45

Current Account and Financial Account

7. 고용 및 임금 ····················································································································· 47

Employment and Wage

8. 물가 ····································································································································· 49

Price Indices

9-1. 금융시장 (I) ······················································································································· 51

Financial Market (I)

9-2. 금융시장 (II) ······················································································································ 53

Financial Market (II)

10. 부동산시장 ························································································································· 55

Housing Market

11-1. 세계경제 동향 (I) ·············································································································· 57

Major Indicators of the World Economy (I)

11-2. 세계경제 동향 (II) ············································································································· 59

Major Indicators of the World Economy (II)

[ 요약 ]

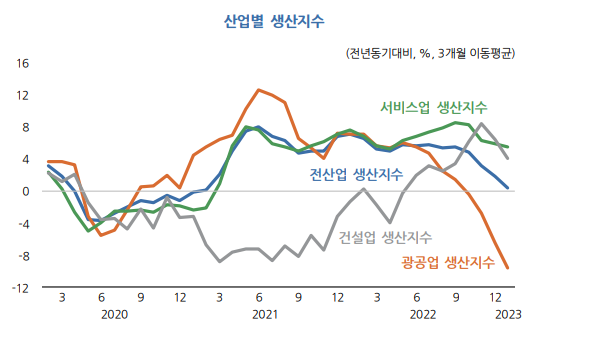

최근 우리 경제는 수출이 위축된 가운데 내수도 둔화되면서 경기 부진이 지속되는 모습

대외여건 악화에 따른 수출 부진으로 제조업 경기가 위축되고 있음.

╺ 수출은 지역별로는 대중국 수출을, 품목별로는 반도체를 중심으로 부진이 지속됨.

╺ 이에 따라 제조업은 반도체를 중심으로 생산이 대폭 감소하고 재고는 급증하는 등 위축된 모습을 보임.

╺ 제조업의 부진으로 설비투자가 감소하고 고용 증가세는 둔화됨.

금리인상의 영향이 점차 파급되며 소비와 건설투자도 부진한 모습

╺ 소비는 소매판매의 부진이 이어지고 서비스업생산 증가세가 약화되는 등 점차 둔화되고 있음.

╺ 고금리 기조에 따른 부동산경기 하락으로 건설투자도 부진한 흐름을 보임.

한편, 중국의 리오프닝에 따른 경기 회복에 대한 기대로 심리지수가 개선되고는 있으나, 실물지표는 여전히 부진한 상황

╺ 중국의 리오프닝 이후 서비스업을 중심으로 경기 회복에 대한 기대가 반영되며 대내외 서비스업 관련 심리지수가 개선됨.

╺ 그러나 對중국 수출이 여전히 위축되어 있고 중국 실물지표의 부진이 지속되는 등 중국의 리오프닝의 실물경기에 대한 긍정적 영향은 아직 가시화되지 않음.

※ 본 서비스에서 제공되는 각 저작물의 저작권은 자료제공사에 있으며 각 저작물의 견해와 DATA 365와는 견해가 다를 수 있습니다.